Using the Patent Asset Index for Company Portfolio Evaluations

In the 2014 Alice case, the United States Supreme Court was tasked with determining whether patent claims directed at a computer-Company portfolio evaluations can inform key business decisions in a variety of ways, but the task of analyzing a patent portfolio is not as simple as it seems. In addition to considering straightforward, objective patent portfolio information, such as the total number of patent applications in a portfolio and the time remaining in each portfolio patent’s term, companies need to consider the value of each patent individually to determine the strength of a portfolio as a whole. Fortunately, LexisNexis® IP has simplified patent portfolio analysis with scientifically backed methods and patent data integrated from over 90 worldwide patent offices and complementary sources with a new patent metric available on the LexisNexis® PatentSight® innovation analytics platform.

Determining a Patent Asset Index from Competitive Impact

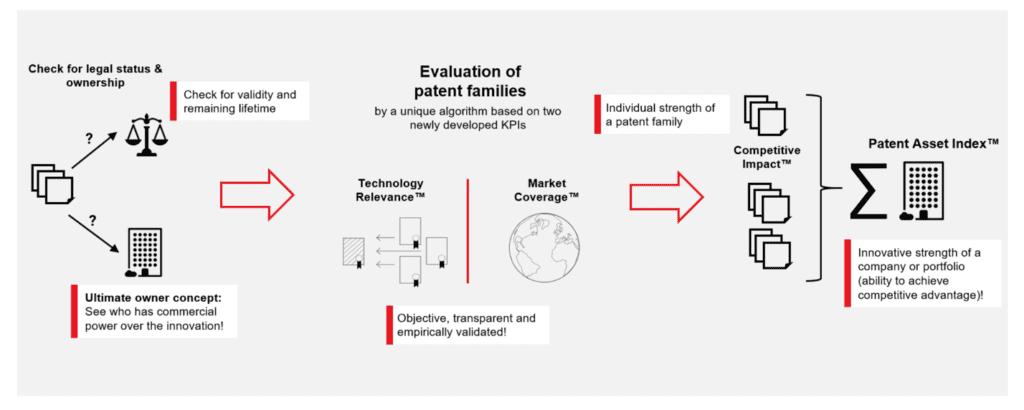

Best described as a measure of the aggregate strength of all the patents that make up a patent portfolio, the Patent Asset Index was developed through many years of scientific research and validation studies. Although it is a simple concept that a patent portfolio is only as great as the sum of its parts, the real magic of each Patent Asset Index is in the methodology used to evaluate each patent within a portfolio. For a reliable measure of a patent’s economic value, the Patent Asset Index looks to each patent’s Competitive Impact™ (i.e., the patent’s value relative to other patents in the same field). Calculating a patent’s Competitive Impact is dependent on two separate, yet equally important considerations—the patent’s Technology Relevance™ and its Market Coverage™.

The first consideration, the Technology Relevance of a patent, is essentially a way to measure the significance of a patent in its technological field. A patent has greater significance if subsequent patents build upon it, which means an effective way to measure a patent’s significance is to determine how often the patent has been cited in subsequent patents and patent applications as being prior art.

The second consideration, the Market Coverage of a patent, is a measure of the commercial markets in the world where patent protection has been granted. The size of each market where patent protection exists is calculated using each market country’s gross national income compared to the gross national income of the United States. PatentSight® does the heavy lifting of calculating each portfolio patent’s Competitive Impact from its Technology Relevance and Market Coverage, and produces a Patent Asset Index to help its users evaluate patent portfolios more effectively and efficiently.

The Patent Asset Index advantage

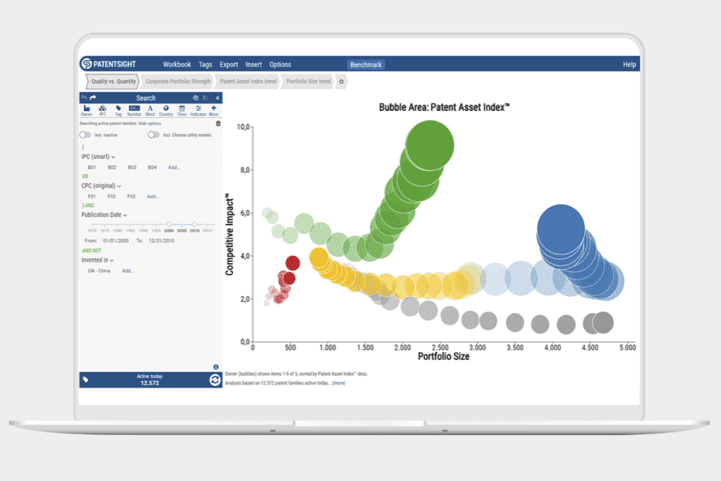

Representing the innovative strength of a company’s patent portfolio, the Patent Asset Index is a patent tool with several advantages. Looking inward, companies can leverage their own Patent Asset Index to identify their competitive strengths and weaknesses in their company portfolio evaluations, which can inform patent filing strategies and ultimately help with the optimization of their patent portfolio. Looking outward, companies can leverage the Patent Asset Index to evaluate competitor patent portfolios to inform business and research and development strategies.

PatentSight users can utilize analytics on company portfolio evaluations in all technological fields to identify their most valuable patent assets, and identify potential patent licensees. The Patent Asset Index opens up a world of possibilities for companies, from increasing the value of their own patent portfolios to uncovering innovation trends worldwide.

Learn more about PatentSight and the Patent Asset Index.

See how to monitor competitors’ portfolio strengths and developments with PatentSight benchmarking.