Moderna, Nike and TSMC Among Pandemic-Era Outperformers in Patent Portfolio Strength

Learn about the pandemic-era outperformers in terms of patent portfolio strength.

Top pharmaceutical and chip companies are among the patent owners who have gained the most momentum in terms of patent portfolio strength over the past two years, according to a new report from LexisNexis Intellectual Property Solutions.

The new listing of 100 patent owners leading in what the data provider calls “innovation momentum” – the degree to which their “technology relevance” has advanced compared to peer companies in a 24-month span – sheds light on IP owners of various sizes that have outperformed peers based on strictly qualitative metrics.

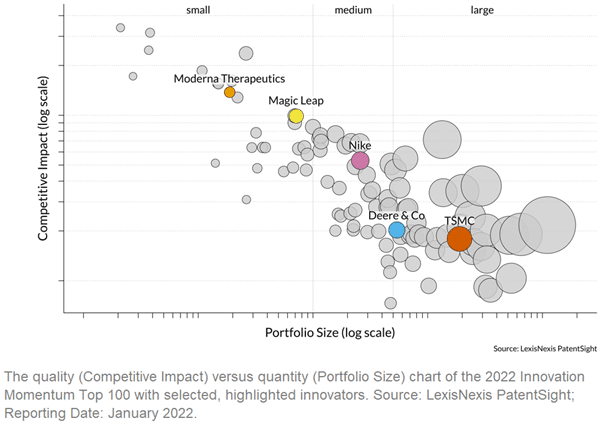

The line-up highlights both big portfolio owners who are omnipresent on lists of top filers but at the same time excel in quality (like TSMC) as well as owners of smaller portfolios that are fast growing in commercial relevance – the likes of Moderna, Magic Leap and Lam Research.

The only condition for inclusion in the ranking is having 10 patent families or more. William Mansfield, a co-author of the report, explains that the smaller players need big, recent jumps in asset value to qualify: “Outperforming the peer group means that the technology relevance has significantly increased for smaller portfolios or has been maintained or even increased in the case of larger portfolios.”

The results yield 29 firms with holdings below 1,000 patent families, 38 with large portfolios of 10,000+ and 33 falling somewhere in between.

Large companies cited in the report include leading semiconductor foundry TSMC, whose mastery of the most advanced chip manufacturing processes means that its sizable portfolio is continuously pushing the boundaries technologically.

In the medium range, Nike and Deere & Co stand out as brands that have not always been associated with high-tech wares but have built patent portfolios with strong technical relevance. Nike has made significant advances in manufacturing and design, while Deere’s latest agricultural machinery includes technologies such as self-driving, unmanned aerial vehicles for task assessment and multifactor assessment of crop performance.

Prominent smaller companies include Magic Leap, whose technologies cover a wide number of areas required for immersive augmented reality, and Moderna Therapeutics, which develops RNA-based therapeutics including its widely known covid-19 vaccine.

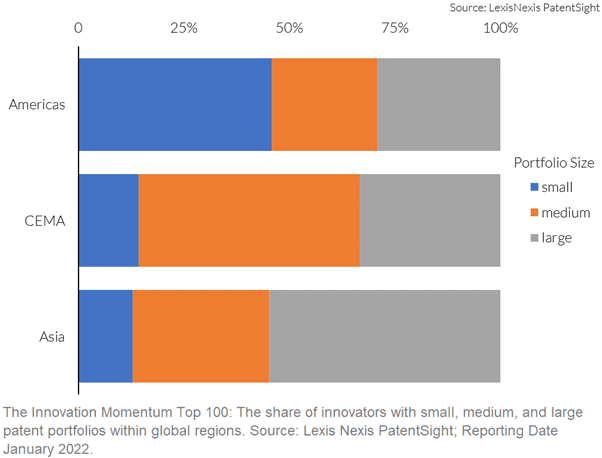

The United States is home to the greatest number of Top 100 firms, and it is the market where the share of small-portfolio innovators is the highest by far. Europe is represented by a large share of medium-sized portfolios, while large patent holdings dominate among the Asia-based innovators on the list. “It could be speculated that difference in the entrepreneurial culture may support these findings,” Mansfield says, “but it is likely a hasty conclusion.”

China is the best-represented market outside of the US. But its contribution includes not just well-known giants like Huawei and Tencent but also more under-the-radar firms. For example, a trio of electronics components makers developing solutions around voice control and touch recognition in devices – AAC Technologies, Goertek and Goodix – all make the list.

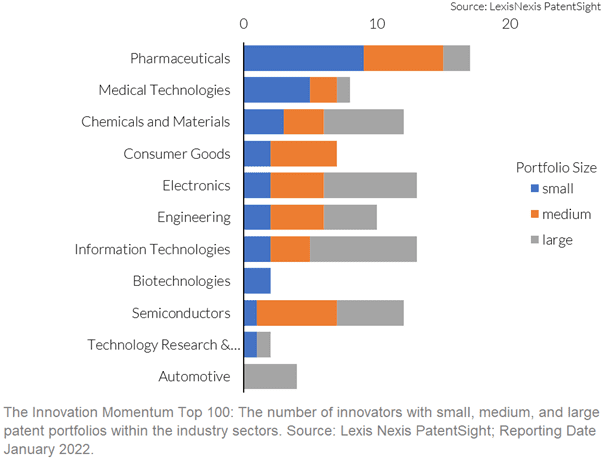

As the report points out, the industry make-up of the 100 identified innovators is “nearly a direct reflection of the most pressing global topics”. High among these are life sciences companies racing to continue addressing covid-19 and other complex medical issues and the semiconductor sector, whose complex supply chain is having ripple effects throughout the whole economy.

Both are industries in which small and specialised players can be just as important from an innovation perspective as the biggest companies.

The life sciences companies on the list span big pharma players like Johnson & Johnson, Roche, and Sanofi along with smaller portfolio-holders Revolution Medicines, CureVac and Moderna Therapeutics. “New biotechnologies like CRISPR/Cas-9 have opened the venue for new small, innovative companies,” Mansfield points out.

Similarly, it is no surprise to see Intel, Qualcomm, or TSMC among the portfolio owners with the greatest momentum. But recent supply chain developments have underlined the critical importance of companies that have smaller IP portfolios but very big technological impact, including ASML and Lam Research, both of which are among the Top 100.

This article was originally published on IAM.