Innovation Momentum 2022: The Chemicals and Materials Industry

Dirk Caspary

April 11, 2022

Check out the 2023 version of the Innovation Momentum report, available now!

In January 2022, we published the report “Innovation Momentum 2022: The Global Top 100“. Innovation Momentum is an unbiased methodology used to identify innovators who outperformed their peers over the period of the previous two years. The result is a more inclusive list of innovators, capturing not only mature multinational innovators but also small start-ups with early disruptive innovation.

Innovation Momentum 2022 focuses on the top 100 innovators across industries and highlights a few of the technological groups with the most innovation representation on the list. One of the stronger categories without its own deep dive in the report is the Chemicals and Materials Industry. In this blog post, we take a closer look at the innovators in the Chemicals and Materials industry.

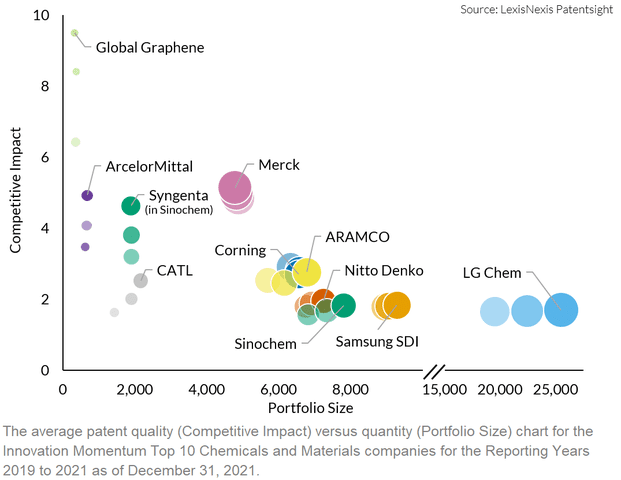

The quality versus quantity chart above plots the average patent quality (as measured by Competitive Impact) versus the quantity (Portfolio Size) for the top 10 Chemicals and Materials companies. The size of each bubble in the chart illustrates the overall portfolio strength (measured by Patent Asset Index). Please note, in addition to the top 10 Chemicals and Materials companies, the chart also comprises Syngenta, a subsidiary of Sinochem.

These companies can be classified into two groups. The first one consists of Corning, ARAMCO, Nitto Denko, Samsung SDI, and LG Chem who own relatively large active patent portfolios, that grew in number over the last two years. Usually, it is observed that the average patent quality declines if large portfolios continue to grow, which does not apply to these companies.

The second group comprises Global Graphene, ArcelorMittal, Syngenta, Contemporary Amperex Technology Co. (CATL), and Merck KGaA. These five companies all have a smaller portfolio size in common, each of which increased its average patent quality (Competitive Impact) over the last two years while maintaining or moderately increasing their portfolio size. Generally speaking, it is not difficult to increase the average patent quality of a small portfolio, because a small number of patent families of high quality have a higher impact on the average quality than in a large portfolio. Thus, in order to achieve a good Innovation Momentum with a small portfolio, the increase in the average patent quality has to be disproportionately high.

These two groups of patent portfolios are characteristic to the Innovation Momentum, or the other way round, the Innovation Momentum can be used to easily identify such kinds of portfolios. The Innovation Momentum can also be computed for companies; business units or subsidiaries as demonstrated in the example of Sinochem and Syngenta; specific technologies or fields, or even combinations of the above.

Want to see the full Innovation Momentum 2022 list of the global top 100? Get the report now.

Watch the on-demand webinar What You Can Learn from the World’s Leading Innovators.