David Swallows Goliath – Insights About AMS’ Acquisition of OSRAM From a Patent Perspective

Andreas Lubbering

December 11, 2019

Last Friday AMS announced that it finally acquired more than 55% of Osram’s shares taking a crucial step in acquiring one of Germany’s most known companies. Osram Licht AG is a multinational lighting manufacturer headquartered in Munich offering innovative and sustainable lighting solutions. AMS AG designs and manufactures advanced sensor solutions. With the AMS’ acquisition of Osram the company wants to create a world-class photonics and sensor champion.

Besides these eager plans and AMS growing rapidly in the last years, there is skepticism that AMS, which is merely a third of the size of its takeover target, would not be able to manage a global company like Osram. The size difference between the merging companies is also visible looking at the patent portfolios, which we want to have a closer look at.

For the correct evaluation of patent portfolios, it is crucial to know the current owner of a patent family, which is quite difficult – especially taking M&A activities such as this one into account. LexisNexis® PatentSight®, therefore, contains company structures including all domestic and foreign subsidiaries, joint ventures and group companies. The harmonized Ultimate Owner also includes former names of the company itself or of any of its subsidiaries.

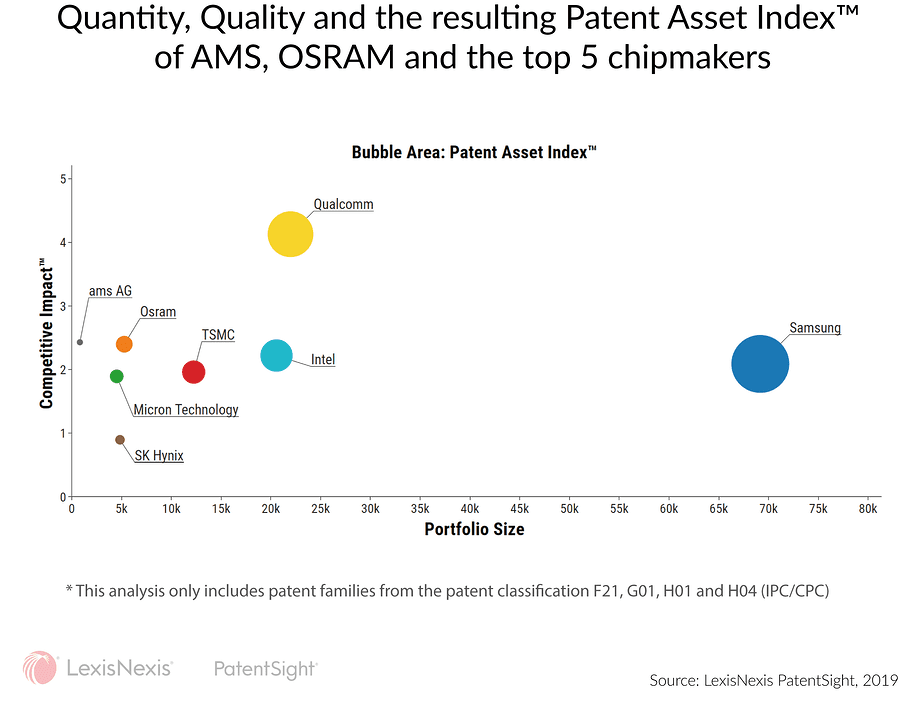

Samsung clearly dominates the field having the biggest portfolio owning 69,127 patent families (measured in Portfolio Size). The Portfolio Size, however, only reflects the peer group’s IP performance in terms of quantity and do not take into consideration the quality of their portfolios. To gain deeper insights into the portfolios of the companies, PatentSight uses the Patent Asset Index. The Patent Asset Index is a scientifically proven IP benchmarking instrument and was used among others by the European Commission in the merger case between Bayer and Monsanto in 2018. Taking into consideration not only the quantity but also the quality of the patents owned by an organization, this indicator allows to accurately measure the overall strength and quality of the organization’s patent portfolio.

Taking into account the quality of patents we can see that e.g. Qualcomm controls a high-quality portfolio (measured in Competitive Impact and, hence, has a similar overall strength (measured in Patent Asset Index) as Samsung despite owning considerably less patents. Osram definitely plays a role within the peer group owning the 5th biggest and strongest portfolio. Also, their average quality is slightly higher than the quality of the bigger players, such as Samsung, Intel and TSMC. In alignment with what was said earlier, AMS seems to play a minor role in the field. While all companies at least own 5,000 patent families, AMS only has a Portfolio Size of roughly 1,000 patent families. As a consequence, AMS also has the smallest Patent Asset Index. So, Osram can be confident going into this partnership from a patent point of view (figure 1).

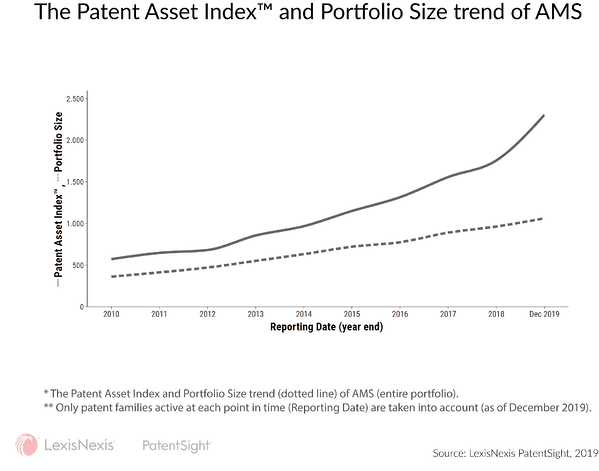

Nevertheless, AMS shows a similar average quality as Osram. In addition, AMS is steadily increasing in Portfolio Size (dotted line) and portfolio strength (figure 2) depicting AMS rapid pace since 2010. Especially in the last year we can see an acceleration. Looking at the relation between Portfolio Size and Patent Asset Index, we can directly assess how the average quality of the AMS portfolio developed. The higher above the Patent Asset Index line is over the Portfolio Size line the higher the average quality. This follows to the conclusion that while increasing their Portfolio Size, AMS was also able to increase the average quality of their patents. A path you don’t see too often, looking at an increasing portfolio.

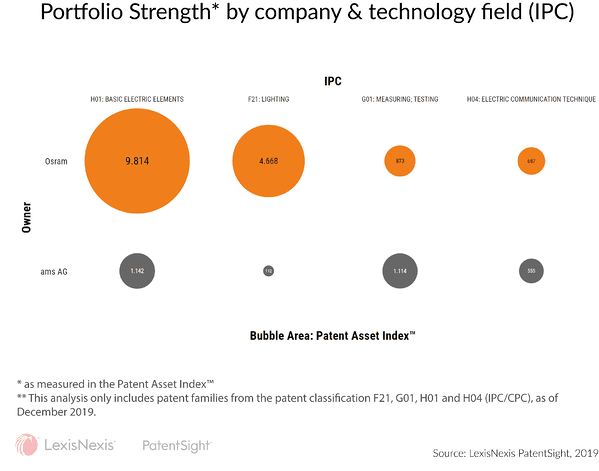

In addition to its recent growth, the AMS’ acquisition will massively increase in portfolio size and portfolio strength. The combined company will have a portfolio size of more than 6,500 patent families and a total Patent Asset Index of roughly 15,000. Especially in the field of lighting the Osram portfolio will significantly strengthen the AMS portfolio. Only in the field of measuring and testing AMS has a bigger portfolio strength than Osram (figure 3).

Going forward it will be interesting to see if the AMS’ acquisition of Osram will allow AMS to keep up its pace and will be able to integrate the Osram portfolio, which is roughly 6 times the size of the AMS portfolio. If this happens in a reasonable way the vision of a world class photonics and sensor champion photonics could become reality.

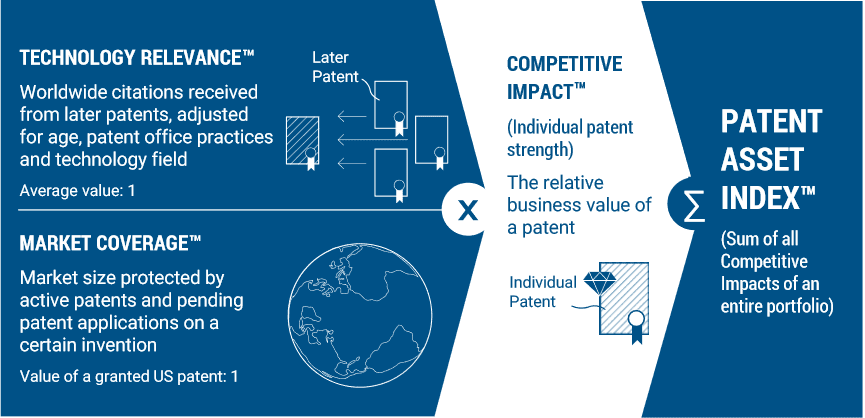

The Patent Asset Index

The Patent Asset Index serves as a measure of the overall strength of a patent portfolio. It is understood as the sum of the Competitive Impact of each patent family within this portfolio. The Competitive Impact, in turn, is calculated for each patent family by multiplying its Technology Relevance with its Market Coverage.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

About the author: Andreas Lübbering

Andreas is a Senior Consultant at LexisNexis PatentSight. Holding a degree in mechanical engineering and business administration, he makes sure that users are successful with PatentSight and gives professional support in their daily tasks.