Will Intel Eventually Buy IBM Electronics?

by Dr. Dirk Caspary

Do you recall July 1, 2015? This was the day when it was announced that GlobalFoundries (GF) has completed the acquisition of IBM’s semiconductor device manufacturing business unit called “IBM Electronics”. This was just six years since AMD spun out its fab operations named GlobalFoundries, in which the Abu Dhabi sovereign wealth fund Mubadala Investment Co. took a majority stake. Now, another six years later, it is reported by the Wall Street Journal that Intel may buy GlobalFoundries from Mubadala Investment Co. With an acquisition of GlobalFoundries, which ranks third among the top global semiconductor foundries, Intel would eventually enter the foundry business after its first attempts in 2013. Back then, Intel started manufacturing field programmable gate arrays (FPGA) chips for Altera, and then bought Altera in 2015.

For a while, Intel is not alone anymore at the cutting edge of process technology, which is the technology about how to fabricate computer chips. Aside from quick access to new production capacities and new customers, what does Intel gain in terms of semiconductor process technology if the deal gets through?

Silicon-on-insulator is the first technology that comes to my mind. In contrast to conventional bulk silicon wafers, silicon-on-insulator (SOI) wafers consist of a carrier wafer with an isolating layer, and on top of a thin single crystal silicon layer for the devices and circuitry. Thus, the name silicon-on-insulator wafer. Proponents of the SOI technology point out various advantages of SOI devices like reduced power consumption and simpler device manufacturing. In case you owned a desktop computer with an AMD Shanghai (45 nm process, 2008) or Llano (32 nm process, 2011) CPU, you even had an SOI chip.

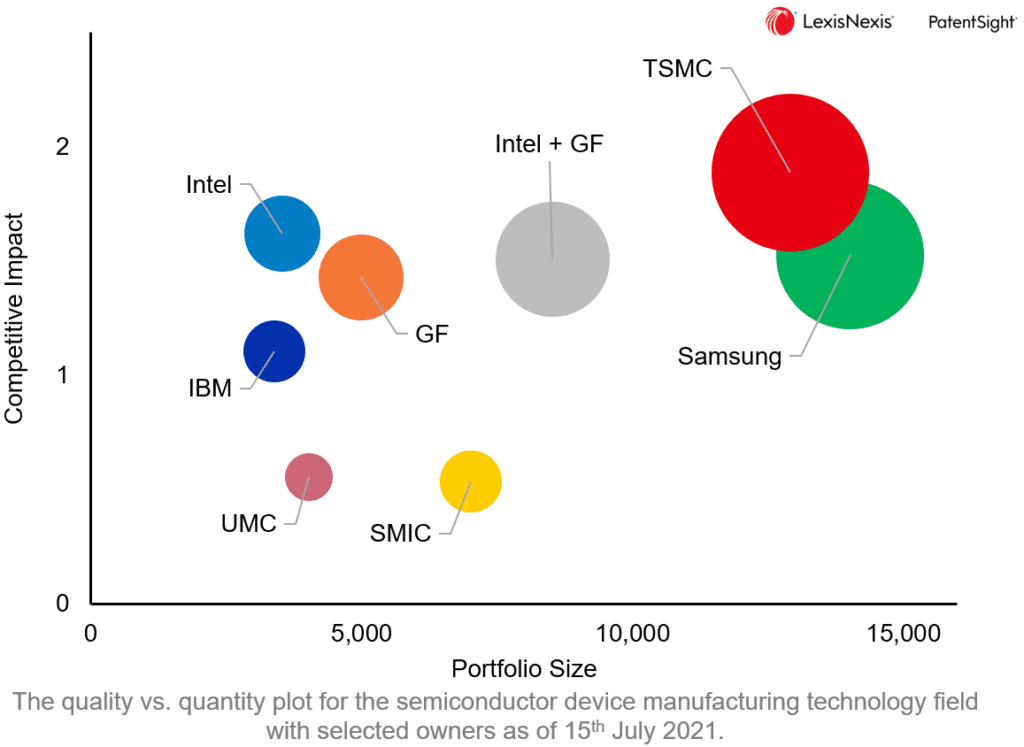

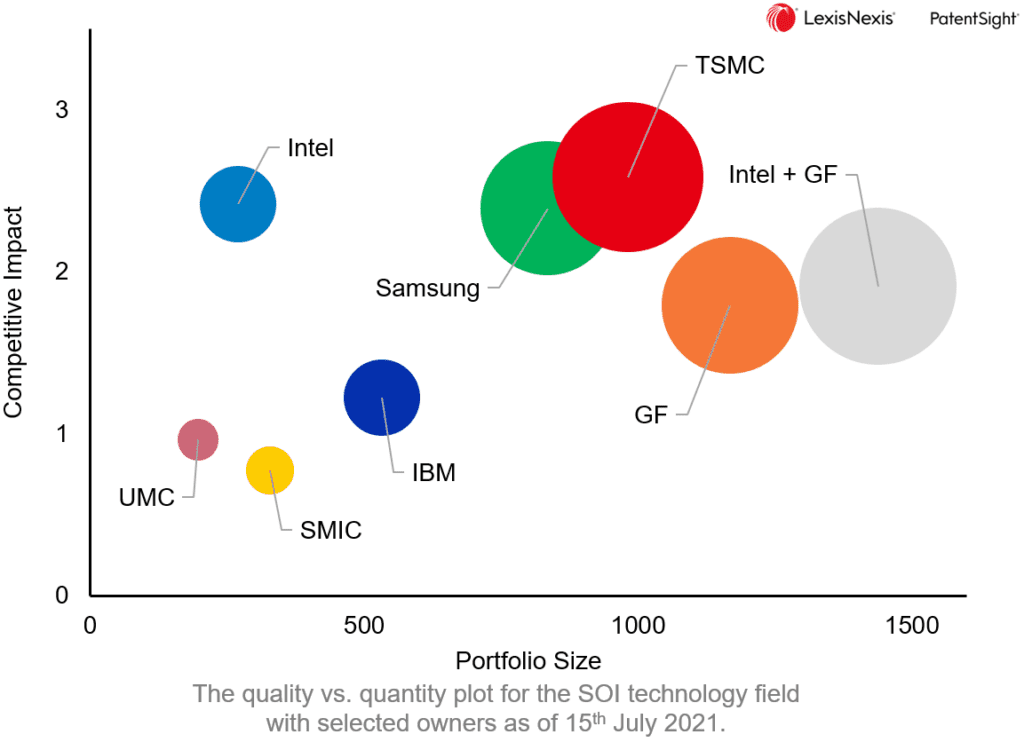

For the analysis, a patent database query is set up which combines aspects of semiconductor manufacturing and SOI technology, and the analysis focusses on the top semiconductor foundries Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, GlobalFoundries (GF), United Microelectronics Corporation (UMC), Semiconductor Manufacturing International Corporation (SMIC), plus Intel and IBM. Please note, that image sensors are excluded in this analysis. The search was performed using the LexisNexis® PatentSight® business intelligence platform.

As a reference, the figure shows the well-known state of semiconductor device manufacturing for the Reporting Date July 15, 2021. The figure shows the Patent Asset Index, i.e. the strength of a portfolio, as a product of its two components, the Portfolio Size, and the average quality of the patents in the portfolio – Competitive Impact. As reported earlier, TSMC leads the technology field of semiconductor device manufacturing in terms of average patent quality (Competitive Impact) and portfolio strength (Patent Asset Index). Samsung is second in both measures but needs a larger Portfolio Size to achieve its Patent Asset Index due to the lower average patent quality (Competitive Impact). GlobalFoundries ranks third with its Patent Asset Index, followed by Intel which has the second-best average patent quality (Competitive Impact) after TSMC.

Now, let’s switch the focus to silicon-on-insulators. The quality (Competitive Impact) versus quantity (Portfolio Size) summarises the current SOI technology for the selected seven patent owners. Again, TSMC ranks first in terms of portfolio strength (Patent Asset Index) and average patent quality (Competitive Impact), followed by GlobalFoundries and Samsung. GlobalFoundries’ portfolio is already the largest SOI portfolio among selected owners, the acquisition of Intel would lead to an even larger portfolio.

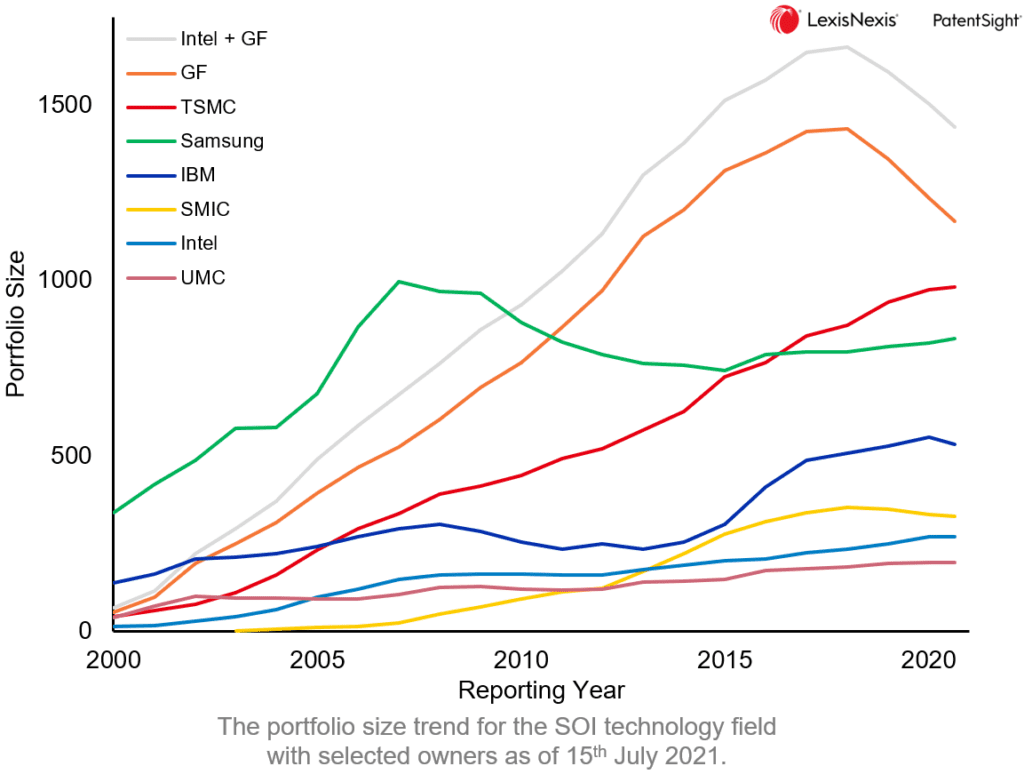

This figure shows the Portfolio Size trend for silicon-on-insulator related patents over the last 20 years. Please note, that the PatentSight Owner concept is used, which means that all patents are shown with their current owners as of today. For example, silicon-on-insulator related patents that were acquired in 2015 by GlobalFoundries from IBM Electronics are shown as GlobalFoundries patents.

GlobalFoundries has the largest silicon-on-insulator portfolio, but the Portfolio Size apparently has passed its maximum. TSMC is second in terms of Portfolio Size, and Intel has continuously increased its silicon-on-insulator Portfolio Size, on a low level, in the last years. This is a surprise to me as I didn’t have silicon-on-insulator on my radar for Intel. However, more than 57 % of these patents are associated with finFET or gate-all-around (GAA) transistors related CPC classifications like H01L 21/823821, H01L 21/845, H01L 27/0886, H01L 27/0924, H01L 27/1211, or H01L 29/0673. Flipping through the more recently published Intel patents confirms this impression. So, the combined SOI portfolio of Intel and GlobalFoundries would be dominated by the patents contributed by GlobalFoundries.

In case Intel acquires GlobalFoundries, in the semiconductor device manufacturing technology field, Intel’s resulting patent portfolio would reduce the gap to the portfolio strength of the biggest foundries TSMC and Samsung. From the findings, it does not look that the silicon-on-insulator technology is GlobalFoundries’ dowry. Probably the acquisition is really about the production capacity. Time will tell.

Nonetheless, Intel would get a lot of legacy: More than half of GlobalFoundries’ active portfolio and more than two thirds of its portfolio strength originates from IBM Electronics.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.