6 Insights From Patent Analytics to Understand Why Amazon Bought Zoox

On June 26th, Amazon announced via their blog they are acquiring autonomous ride-hailing vehicle startup Zoox. Financial terms of the acquisition were disclosed. However, the Financial Times says Amazon paid $1.2B for Zoox. Launched in 2014, Zoox began with the vision of producing zero-emissions vehicles for autonomous ride-hailing services. Insights from patent analytics help us to understand why Amazon chose to acquire Zoox over the many other alternatives available.

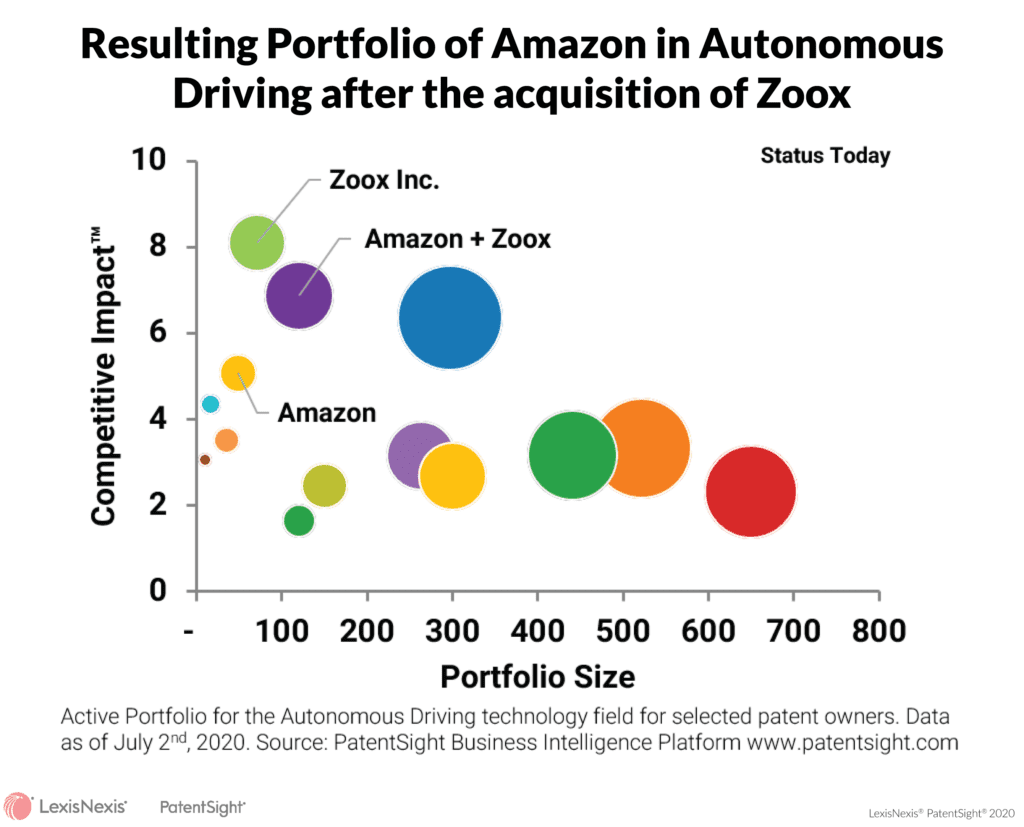

- Amazon’s competitive impact on autonomous vehicles nearly tripled as a result of the acquisition.

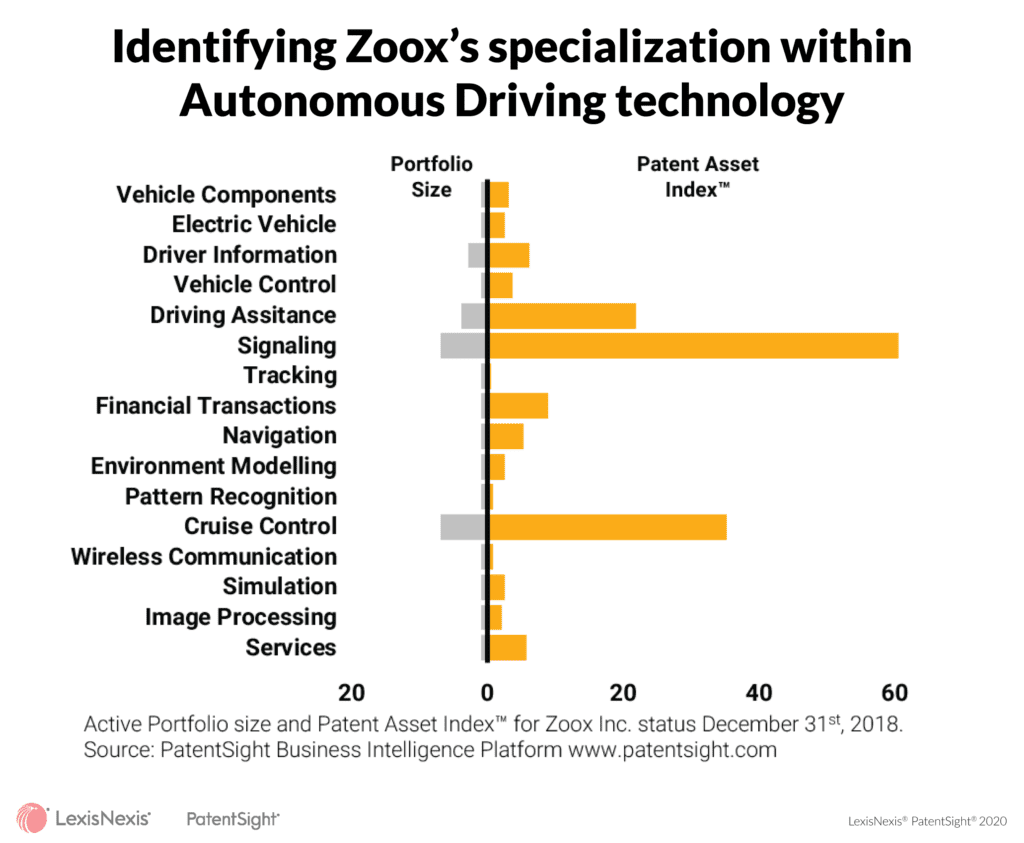

- Zoox’s patent portfolio is particularly strong in the areas of driving assistance, signaling and cruise control, three areas Amazon needed to strengthen along with reinforcement-based machine learning techniques to support autonomous vehicles.

- Autonomous ride-hailing services and logistics are two markets Amazon looks to expand into quickly with Zoox’s expertise.

- Zoox has 154 patent families, with many of them reflecting the startups’ expertise with reinforcement machine learning-based development.

Patents are an excellent proxy for innovation and patent portfolios are essential for competing in fast-growing new markets. Interested to see what motivated Amazon from a patent standpoint to acquire Zoox, I asked LexisNexis® PatentSight®, who specializes in cleaning and refining patent data and providing advanced insights from patent analytics for an analysis of the patent landscape of autonomous driving.

PatentSight is based on manually supervised and scientifically developed algorithms trained with best-in-class patent ownership data that meets and exceeds the standards of the World Intellectual Property Organization (WIPO). PatentSight analysis found patent filings for autonomous driving have increased 10-fold in the last ten years.

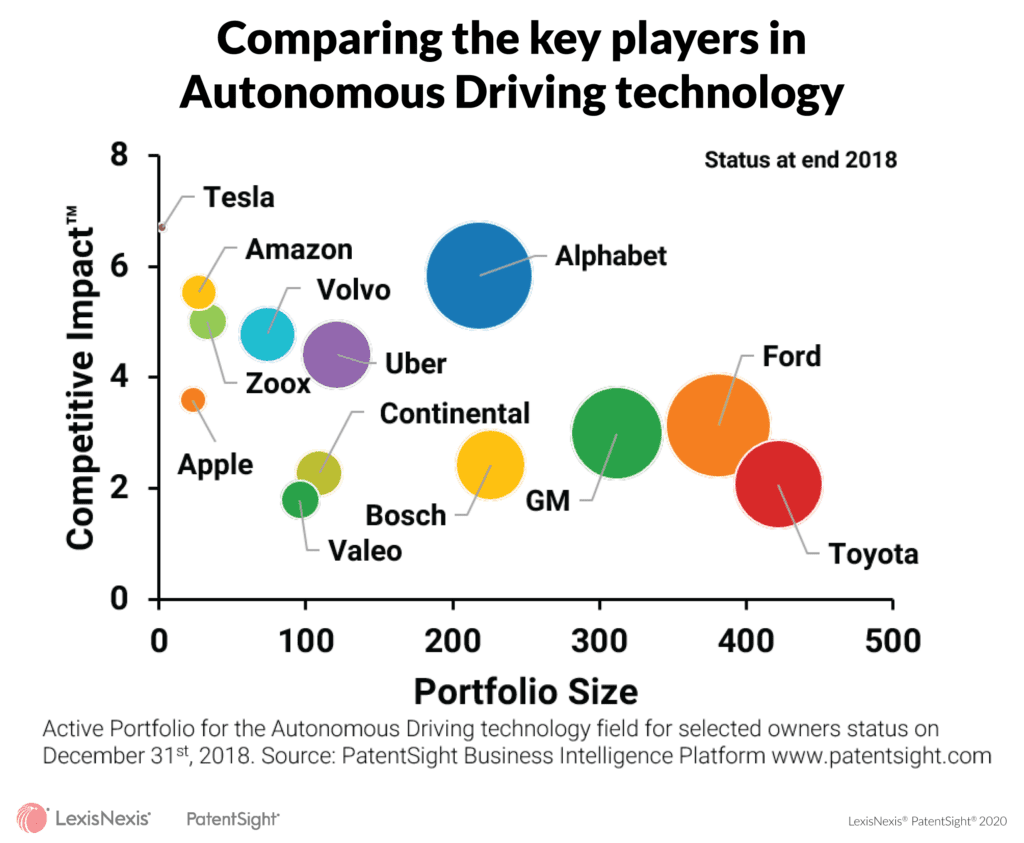

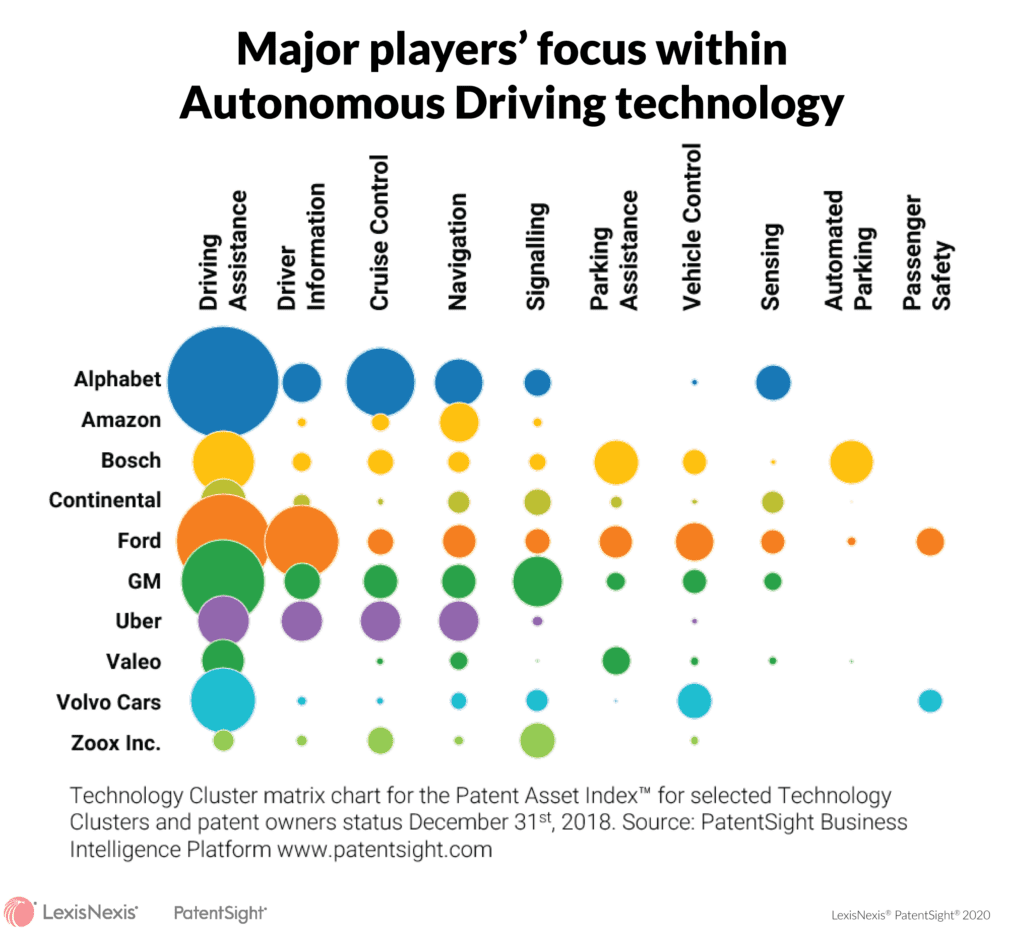

The Competitive Impact of Zooxs’ patent portfolio was scaling above its size as a startup as early as 2018, making it a prime candidate for acquisition. Tech companies, including Alphabet and Amazon, were achieving greater patent density than traditional auto manufacturers. Like Zoox, they are relying on their expertise in AI and machine learning to create extensive patent portfolios. Traditional, mature car manufacturers have relatively large portfolios with average patent quality. OEMs follow the traditional car manufacturers in terms of portfolio size and quality. Among the traditional car manufacturers and the OEMs in the analysis, only GM, Ford and Volvo Cars had in 2018 an average Competitive Impact above the average score of 2.5 for Autonomous Driving.

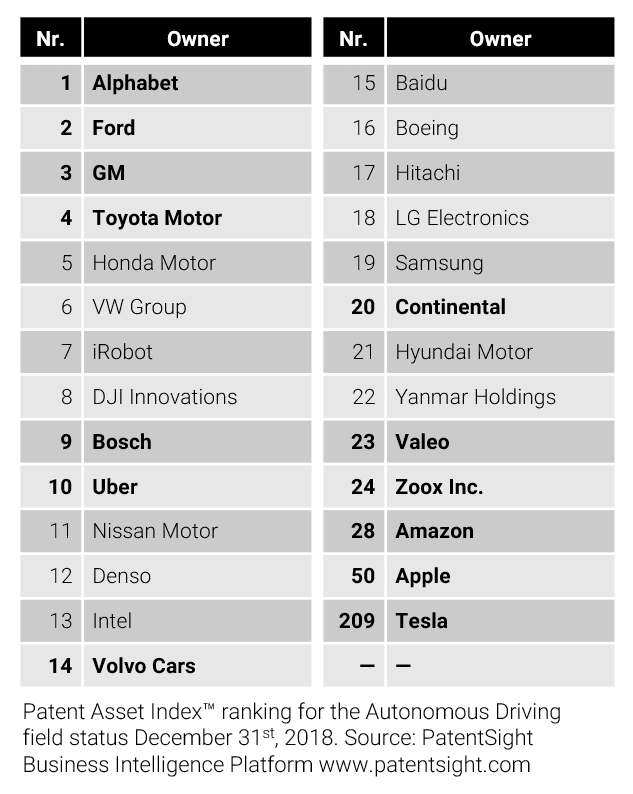

Analyzing the patent portfolio quality of leading autonomous vehicle patent owners using the Patent Asset Index finds that Zoox’s pace of innovation had been slowing versus other patent leaders. PatentSight analysis found that while Zoox has a formidable patent portfolio, the speed and scale that competitors were able to achieve was outpacing them. As a result, Zoox was losing ground on patents to larger, more established competitors, making them an ideal candidate for acquisition.

Zoox’s Autonomous driving patent portfolio reflects high-quality patents as measured by the Patent Asset Index, another factor favoring their acquisition. Comparing the total Portfolio Size and Patent Asset Index by category further illustrates why Zoox was an outlier in the group of leading autonomous vehicle patent portfolio owners and an ideal acquisition candidate. Any company acquiring them gains an immediate technology advantage in driving assistance, signaling and cruise control.

Creating a Technology Cluster Matrix comparing the highest-scoring autonomous vehicle patent areas by patent portfolio owner provides further insights into why Amazon chose to acquire Zoox. PatentSight Technology Cluster matrix maps the highest-scoring technology clusters of Autonomous Driving technologies for patent owners. As the analysis shows, traditional car manufacturers and OEMs have comparable patent distributions equal in patent quality. Technology companies and new car manufacturers have a greater focus on patents in the Driving Assistance cluster. Comparing Zoox and Amazon shows why the startup is a perfect fit given its strong position in Signaling and Cruise Control.

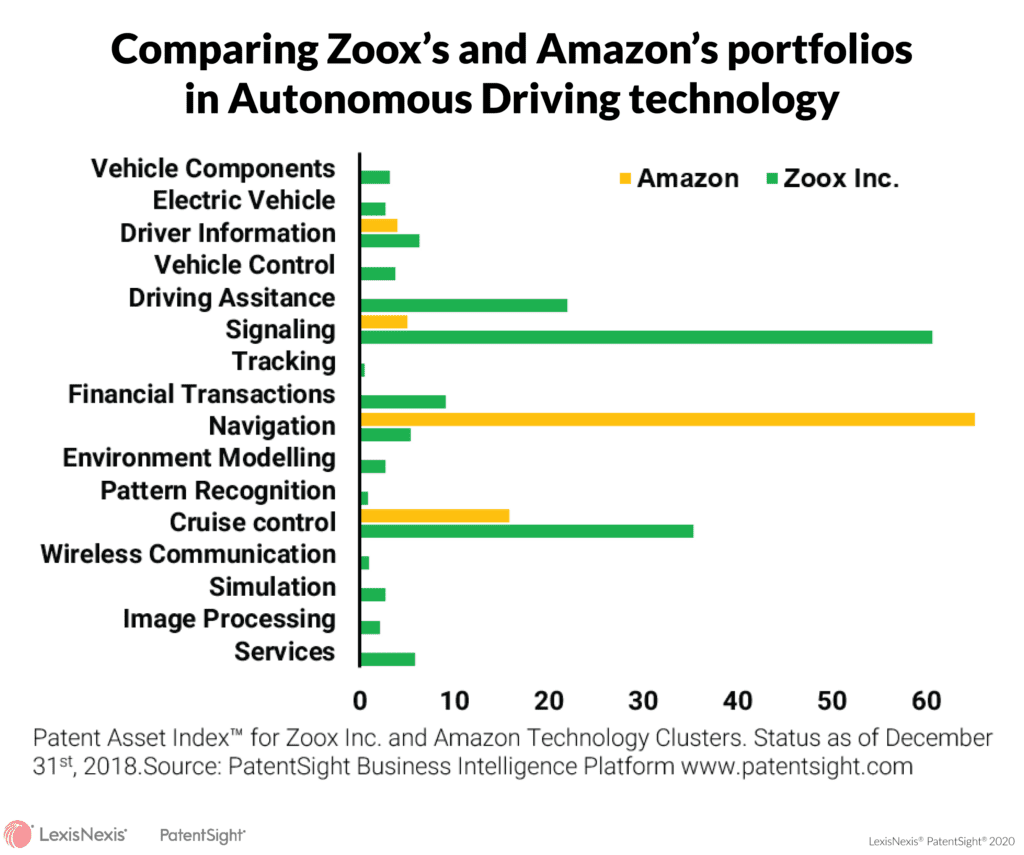

Comparing autonomous vehicle patent value between Amazon and Zoox further clarifies why the startup was acquired last month. The following graph compares the Patent Asset Index for each category of autonomous driving patent development Amazon and Zoox are active in today. Amazon’s shortcomings in the areas of Driving Assistance, Signaling and Cruise Control needed to be offset to support their growth strategies in autonomous vehicles in general and with ride-hailing vehicles and logistics-based uses specifically.

By acquiring Zoox, Amazon will significantly strengthen its position in Autonomous Driving technology patents. Earlier this month PatentSight factored in Amazon’s acquisition of Zoox to quantify the change in the company’s autonomous vehicle patent portfolio. Acquiring Zoox has significantly improved the average patent quality of Amazon’s patent portfolio in autonomous vehicles.

Conclusion

Using insights from patent analytics to understand why Amazon acquired Zoox provides a fascinating glimpse into how startups with deep AI and machine learning expertise can attain comparable patent quality as their much larger competitors. Amazon needed to fill gaps in its autonomous vehicle patent portfolio and Zoox’s complementary patent strengths in Driving Assistance, Signaling and Cruise Control are a perfect fit. Amazon saves years of Intellectual Property (IP) development in autonomous vehicles and has a ready-to-go beta test lab in their warehouses to test out new logistics use cases.

Learn more about PatentSight and the Patent Asset Index.

Watch the on-demand webinar Chasing Innovation ‘Unicorns’ to hear our experts examine and discuss:

- An overview analysis of the autonomous driving patent landscape

- A comparison of selected automotive OEMs and their portfolio in autonomous driving

- A break-down analysis of Zoox’s patent portfolio in autonomous driving

- The specifics of Amazon’s patent portfolio in autonomous driving before and after the acquisition

- Implications for the automotive industry and other autonomous driving unicorns like Zoox Inc.

Excellent data quality is the foundation for reliable insights from patent analytics. Learn how PatentSight enhances patent data here.

About the author: Louis Columbus

Louis is currently serving as Principal, IQMS, part of Dassault Systèmes. Previous positions include product management at Ingram Cloud, product marketing at iBASEt, Plex Systems, senior analyst at AMR Research (now Gartner), marketing and business development at Cincom Systems, Ingram Micro, a SaaS start-up and at hardware companies. He is also a member of the Enterprise Irregulars. His background includes marketing, product management, sales and industry analyst roles in the enterprise software and IT industries. His academic background includes an MBA from Pepperdine University and completion of the Strategic Marketing Management and Digital Marketing Programs at the Stanford University Graduate School of Business. He teaches MBA courses in international business, global competitive strategies, international market research, and capstone courses in strategic planning and market research. He has taught at California State University, Fullerton: University of California, Irvine; Marymount University, and Webster University.

Follow Louis on Twitter or LinkedIn. Check out his website.