Value-Driven Innovation and Intellectual Property Management

Carsten Guderian

April 24, 2020

Innovation, like other functions that fuel growth in industries or businesses, require timely and adequate management, from the early detection of novel technologies and new market entrants to developing actionable competitive intelligence, and beyond. Without proper management, there is no guarantee that innovation will lead to achieving strategic targets and organizational objectives. Traditionally, innovation management, intellectual property management, at the organizational level focused on periodic stock-taking, that is counting patents owned by the organization or competitors, later followed by a variety of indicators based on data mined from patents. But, is a patent a mere document only worth its count? Or does it contain intrinsic features that can attest to its quality? What if we told you that it is possible for a company that owns fewer patents to be the technology leader in a field, where another one that owns significantly more patents is lagging far behind.

Today, we begin our new blog series on technology focused competitive intelligence sources, based on patent analytics. We will discuss how scientifically developed patent quality indicators can be used to accurately evaluate innovation efforts. Throughout this series, by analyzing the patents that were filed in the ‘smart-homes’ technology and various other technologies, we explain how patent quality is discernibly present, relevant and important for strategic decision-making. Read on to find out how moving away from a volume-based approach towards value-driven intellectual property management can help you increase business and organizational value.

Modern challenges require modern solutions

Modern day management principles, as recommended by leading management consultancy firms like BCG or McKinsey, place the concept of ‘value’ at the forefront of organizational targets. According to this principle, organizations striving for success should constantly be trying to increase the value that is being created for or delivered to its stakeholders. In terms of intellectual property (IP) and particularly intellectual property management, this means transitioning from trying to own the most patents or being the number one patent filer in a specific country or industry towards a strategy that focuses on owning and filing the right patents.

In such situations, R&D or IP departments that continue functioning on patent count-based approaches towards evaluating their innovation activities would find all of their efforts falling vastly short of what is required and possible. Due to data inconsistencies and as shown in prior research, patent counts and methods that are reliant on solely conventional patent indicators are unable to accurately differentiate between high and low patent qualities and strengths. Further, considering that prior research identified skewed patent relationships, with more than two thirds of all patents filed globally having low or no commercial value, a reliable method to evaluate patents and portfolios based on their intrinsic value, yields additional insights not attainable with conventional approaches. How is that done?

intellectual property management: evaluating patents and patent portfolios

Research on this topic has identified various data points that can be retrieved from patent documents. Conventional indicators used to identify patent qualities comprise, for example, forward citations, patent family sizes, technological and geographical scope, and more. Scientific research conducted by our founders on this topic revealed that patent quality can be distilled into two main indicators: one that measures the quality of the technology protected within (derived from the number of citations a patent has received to account for use of the technology protected by the patent) and the other, a measure of the size of economic markets that are protected by the patent. They named these indicators Technology Relevance and Market Coverage. Together, the product of these two indicators, named Competitive Impact measures the average quality of a patent. Calculating and adding all Competitive Impacts values of patents comprising a portfolio measures that patent portfolio’s overall strength, its Patent Asset Index.

Patents in smart Homes – a technology landscaping report (part 1)

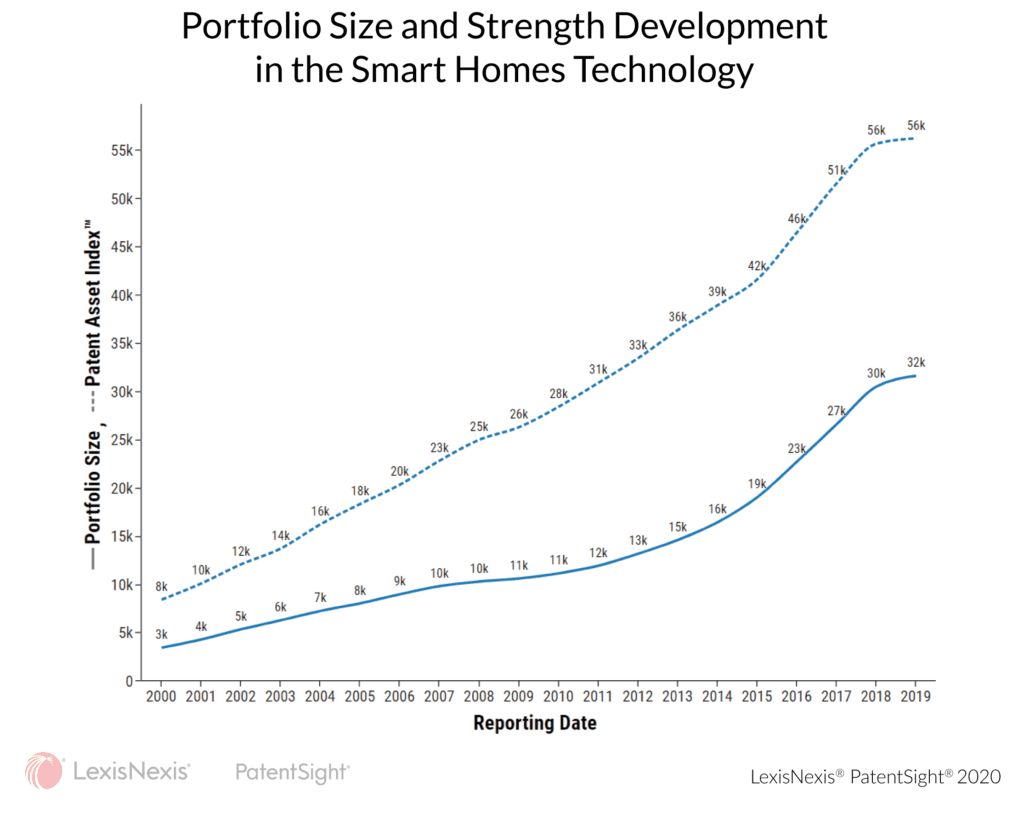

As the first part of our novel blog series on technology intelligence, we may take a look at the following technological landscaping chart, which was extracted from the LexisNexis® PatentSight® business intelligence analytics platform. PatentSight® data harmonization procedures correctly assign patent ownership and legal status, ensuring that analysts may trace the development of patent portfolios over time instead of looking at filed patents only. For each annual value, only active and pending, but no patents that ceased to exist (for example due to lapse or discontinued maintenance) are considered. For this analysis, we look at the technology field of ‘smart homes’ appliances, as defined by experts from EconSight GmbH, an independent Swiss economic research and consulting company specializing in innovation analytics. (For more information on the definition of the technology field, please reach out to us.)

As can be seen from the chart and contrasting common views, smart homes is actually not an entirely novel technology. Patents, qualifying the technological field definition, were already active 20 years ago, in 2000. Over the course of these 20 years, there are no steep but fairly gradual increases in both the number of patents and the total portfolio strength of all smart homes’ patents. More specifically, the number of active patents at each point in time grew by 827.1 percent from 3,403 patents in 2000 to 31,548 patents in 2019, whilst the Patent Asset Index of these active patents at each point in time grew by 570.3 percent from 8,376 to 56,144. In terms of annual growth rates, the largest growth in the number of active patents was detected between 2000-01 characterized by an increase of 25.1 percent from 3,403 active patents in 2000 to 4,258 active patents in 2001. The largest growth in the Patent Asset Index was detected between 2000-01 as a 20.1 percent increase from 8,376 in 2000 to 10,059 in 2001. As a general trend, we see double-digit annual growth rates for the number of active patents from 2001 to 2006 and again from 2012 to 2018. Meanwhile, between the years 2007 to 2011 this field saw only single-digit annual growth rates for the number of active patents. In the case of Patent Asset Index, we detected double-digit annual growth rates from 2001 to 2007 and again for 2016 and 2017. From 2008 to 2015 and between 2018-19 this increase was registered as single-digit annual growth rates.

How do all these figures help us in innovation and intellectual property-related strategic decision-making? First of all, smart houses seem to be a promising technological area. Looking at patents instead of research and development expenditures allows to evaluate innovation based on the quality of research outputs (which is of value) rather than inputs. For this, we look at successfully developed novel technological solutions – i.e. inventions that qualified the objective criteria to obtain patents – that may turn into lucrative innovations if successfully commercialized in the international markets. By looking at patents’ qualities and strengths in addition to mere numbers, we may identify that the players in smart houses are on average developing strong patent portfolios, hinting at the fact that this technology field is promising and might need additional intelligence attention to obtain more insights.

Of course, the chart above provides only a birds-eye view of the technology field. Based on this broad perspective, patent analysts as well as intellectual property managers, innovation management decision-makers and stakeholders may want to drill down into the portfolios of important market players that are actively contributing to the smart homes’ technology or the sub-technologies related to smart homes. This is scheduled for the next edition in this blog series, where we will be looking at some of the top firms that have developed technologies in this field and how their portfolios compare against each other on a Quality vs. Quantity chart.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

See how to use the Patent Asset Index for patent portfolio benchmarking.

For more on technology intelligence read Value-Driven Innovation Management – A closer look at the Top players.

About the author: Carsten Guderian

Carsten is a Senior Project Leader and has a background in Economics and Business Administration, particularly innovation management and patent analytics. He has been affiliated with PatentSight since 2012.

New Report

Who Is Leading the VVC Patent Race?

The VVC codec patent landscape is complex, with multiple patent pools and varying rules across jurisdictions. This report provides strategic insights into competitor portfolios, helping companies make informed IP decisions and stay competitive in the high-resolution video market.