China in Rare Earth Elements – Top Supplier, Major Patent Developer, Yet Portfolio Strength Still a Concern

William Mansfield

September 5, 2019

From recent news reports it became clear that China accounts for almost 90% of the world’s production and supply of the so-called Rare Earth Elements (REE). These are a group of 17 elements that are not commonly found in the earth’s surface. For e.g. Scandium, one of the rare earth elements, is heavily used in manufacturing parts for the aerospace industry. Similarly, these elements have varied and extremely specific uses, for which, at least for the time-being, no viable substitutes can be sourced. We used our excellent patent database and scientifically proven metrics, LexisNexis® PatentSight®, to analyze the current situation around rare earth elements from a patent quality point of view to identify possible opportunities and threats in this business.

On the commercial side of this story, China and US are about to lock horns on this topic which might result in a possible relocation of mining, processing and refining of rare earth elements to other countries. At the same time, on the technological side, this raises the question of whether the contenders, i.e. countries other than China, are prepared with technology that is needed to successfully replace China as the leader.

We used LexisNexis® PatentSight® to take a closer look at the patents filed under technologies relating to rare earth element processes, goods and materials, to find answers to these questions and below are our findings.

China dominates patent filings in Rare Earth Elements

The graphs below show the historical trend that depicts how China has developed its patent portfolio in this technology field, over the past decades. Although China seems to have increased their patenting activities since the year 2010 as clearly seen by the upward curve in the graph showing portfolio development over years (on the left), the overall strength of Chinese patents in rare earths still lag behind those of Japan and the US as can be seen from the graph on the right.

In terms of absolute numbers, China is leaps and bounds ahead of the US and Japan, its two closest competitors, when it comes to patents owned in this technology. But, on comparing the quality of these patents as measured by the portfolio’s Patent Asset Index, China can be seen lagging behind its two major competitors. This could change in the coming years, having observed that China is focusing more on developing this technology while the rest of the world can be seen to be backing off.

What is China missing?

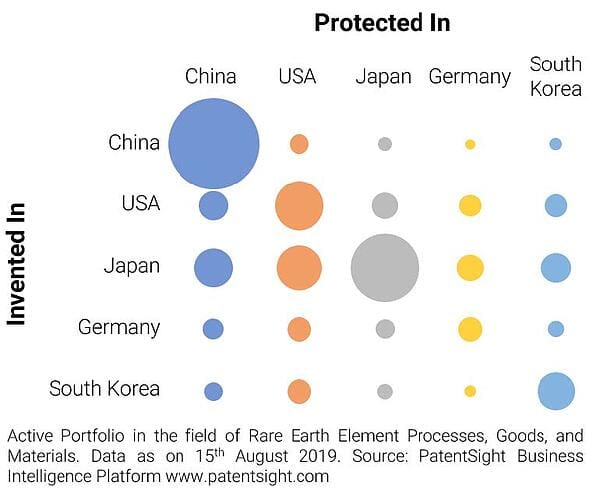

The only kink in China’s road to dominating this technology field is a more common strategy that Chinese patent filers seem to be following, where their inventions are protected mostly only in China. As can be seen from the graph above, which is a template available within our software, the internationalization strategies followed by patent filers in China seem to be fairly non-existent as their filings are almost entirely focused on protection only within China. This could prove to be a problem since other countries could learn from and develop these technologies freely. In view of recent trade war between China and the US, China is reportedly considering restricting its export of rare earths. If this happens the US looks outside of China for these materials, other countries could easily fill up the spot currently occupied by them without infringing on many patents as most of the Chinese patents are not protected globally.

Developing trends in Rare Earth Elements

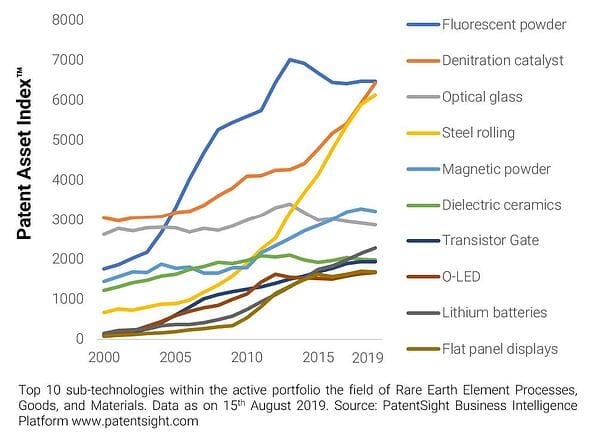

Within rare earth-related patents, there has been observed, a marked increase in quality of patents, related to ‘Denitration catalysts’ and ‘Steel rolling’. Whereas, denitration catalysts find widespread use in relation to reducing the emission of harmful compounds in the form of devices used for treating waste gases. In steel manufacturing, rare earth elements find use as an additive to enhance the mechanical properties of Steel. As seen from the graph below these are the sub-technologies where Chinese inventors have been seen to hold higher quality patents since 2010.

Whatever the case may be, the future of rare earth elements is quite complicated. Given the current geopolitical situation, we know that global buyers may start looking for manufacturers outside of China. Whether these manufacturers are ready with the technology required to process, mine and refine rare earth elements or not, is yet to be discovered. As of now, if you are a rare earth elements producer, you should definitely figure out where you stand with respect to your competition. And if you are a rare earth consumer then you need to figure out which companies in your target supplier country are poised to support your needs. If you are confused how to go about it, contact us for a free demonstration. Our expert consultants will show you how such insights can be derived from our award-winning software.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.