Manage Innovation in Times of Crisis With Patent Analytics

If anything has been brought to light in recent years, it is that crises can occur at any time without warning. When caught off guard by a crisis, businesses often need to respond by tightening their budgets and being more selective of the innovation they fund. But how do they decide which projects are worth the investment in trying times? Rather than relying solely on the instincts of their executives, many companies have turned to modern patent analytics to manage innovation and guide their innovation management decisions.

The LexisNexis® PatentSight® innovation analytics platform provides users with a variety of tools to help them visualize and interpret patent data from all over the world. When companies face budget concerns, they can use PatentSight® to evaluate their patent portfolios and categorize their patents for strategic budgeting decisions. Advanced PatentSight metrics, like PatentSight Technology Relevance, can be used to quantify the amount of value a patent provides to the world at large (based on the number of forward citations it has received, but adjusted for common issues such as the patent’s age).

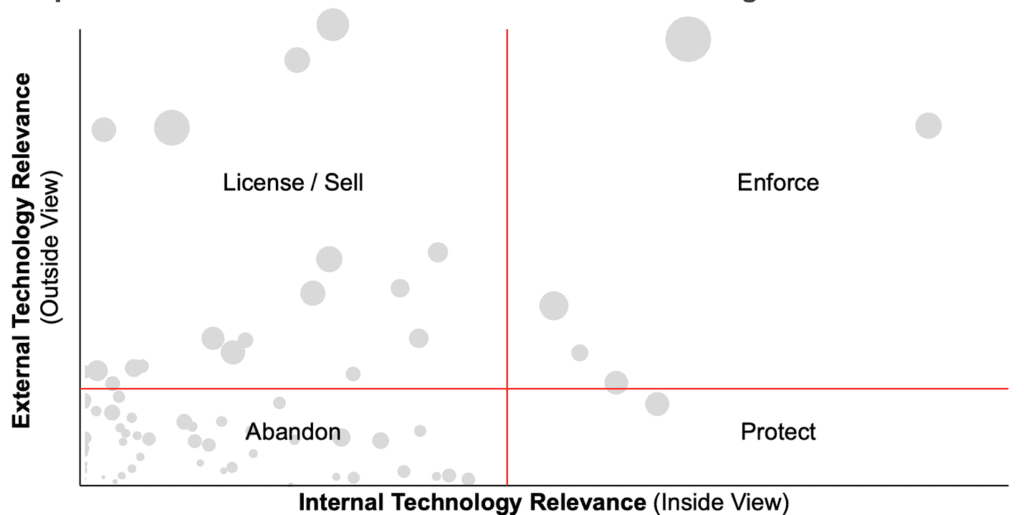

This measure is further differentiated within PatentSight, according to the source of the citations received by the patents in a patent family. All citations from patents that are owned by the same company are used to calculate the Internal Technology Relevance and all the remaining citations account for the External Technology Relevance of a portfolio. When plotted, the resulting chart can be divided into quadrants that are the key to managing innovation and devising better budget strategies. Patents in a portfolio with high Internal Technology Relevance are more important for the owner as they are building on these technologies, hence the higher Internal Technology Relevance values. Conversely if patents in a portfolio have high External Technology Relevance, it means that other companies are building on this technology.

Innovation worth protecting (high internal value, low external value)

When an invention has a significant amount of internal value, indicated by a higher Internal Technology Relevance, by being an imperative business process or revenue-generating product, obtaining patent protection on it is likely a worthwhile endeavor. At the same time, if this invention has little value to the outside world, indicated by a low External Technology Relevance, there is little risk that the patent rights will be infringed. As a result, it is unlikely that the need to enforce patent rights will arise. While companies will still want to budget for patent prosecution costs and patent maintenance fees, there is a low likelihood that they will need to allocate funds to attorney fees and other costs specific to enforcing their rights in a legal dispute.

Innovation worth enforcing (high internal value, high external value)

As discussed, it is worth pursuing patents for inventions that provide a lot of value to a company. When the inventions are also valuable to other companies, it is wise to work patent enforcement costs into the budget. This is because patent rights that are high value to competitors give a patent holder a clear edge over the competition, while exclusivity through patent protection is maintained. In this case, patent owners should budget accordingly to enforce their patent rights and keep their technology from being made, used or sold by others.

Innovation worth licensing (low Internal value, high external value)

If a patent family in a portfolio has low Internal Technology Relevance and High External Technology Relevance, this means that this patent family has value to others than the owner themselves. If so, third parties may be willing to pay a fair price for specific rights to the invention, providing the patent owner with an opportunity to generate revenue through strategic patent licensing agreements. Alternatively, there may be money to be made by assigning the patent to another operator, essentially transferring all patent rights to an invention in one swift move.

Innovation to consider abandoning (low internal value, low external value)

What should be done with patents that are of little value to anyone? Likely nothing, of course. PatentSight innovation analytics can reveal the weak links in a patent portfolio that provide no advantage to the patent owner. Companies may want to deem these weak links as sunk costs, allowing their patent rights to expire and avoiding any further investment in their maintenance.

The PatentSight innovation analytics platform helps users operate more effectively and efficiently through patent analytics and visualizations. In times of crisis or prosperity, PatentSight can provide insights that help businesses manage innovation.

Learn more about PatentSight.

For more details on how to manage innovation in times of crisis read our study.

See how one company uses patent data as an offensive and defensive strategy.